If you’ve recently visited a bustling Chinese city and seen cars seemingly on autopilot, no, you didn’t walk onto a tech expo show floor. Welcome to the era of L2+ Advanced Driver-Assistance Systems (ADAS), China’s new innovation battleground where full-stack solution providers are racing ahead at breakneck speed, and the only real traffic jam is foreign suppliers trying to keep up.

Full-Stack Fever: Huawei, Horizon Robotics, and the Art of the Deal

While the world has been busy debating fully autonomous cars and waiting for regulators to press “accept,” China took a pit stop at SAE Level 2+—and turned it into a superhighway of opportunity. The logic? L3 autonomy is still stuck at the bureaucratic toll booth. But L2+? That’s clearing the fast lane, thanks to domestically-oriented, vertically integrated solutions and a ruthless focus on affordability.

Look no further than Huawei, whose ADAS platform zipped into more than 500,000 vehicles in 2024, nipping at the heels of Tesla’s China sales numbers. Their formula: roll-your-own chips, sensors, and AI—all under one digital roof. It’s a compelling buffet, and carmakers are coming back for seconds. A staggering 52% of all new-energy vehicle startups’ sales in China now boast L2+ capabilities.

Software-Only? “Thanks for the App, Now Please Step Aside”

Chinese automakers, never ones for half-measures, are driving a stake through the heart of software-only ADAS startups. Modular, plug-and-play code? Great for your smartphone—less handy when you want to control everything from the chip to the cloud. Winners like Huawei, Bosch, and Horizon bring the whole ADAS enchilada: from silicon brains to digital eyeballs to clever lines of code.

The result? Software-only stalwarts like Baidu Apollo and Momenta have seen their new contracts plummet by 37%, as local car companies pivot to full-stack marriages that promise tighter integration, better performance, and lower costs.

Three Mega-Trends Shaping China’s L2+ Juggernaut

- The Red Dragon’s New Chips:

Inspired by self-reliance (and perhaps a pinch of geopolitics), Chinese players like Black Sesame Technologies have revved up chip production, with domestic chip adoption jumping a turbocharged 217% in 2024. Huawei’s Ascend AI processors now power over a quarter of premium L2+ rides on the road. - Global Goliaths Get the Wobbles:

Remember when foreign darlings like Mobileye ruled China’s ADAS kingdom? Today, they’re being demoted to lesser models, with local EV brands hitching their fortunes to homegrown talent. Even Bosch, ever the wily veteran, had to team up with WeRide to keep its wheels spinning in the Middle Kingdom. - Vision-First Dominance, Wallet-First… Everything:

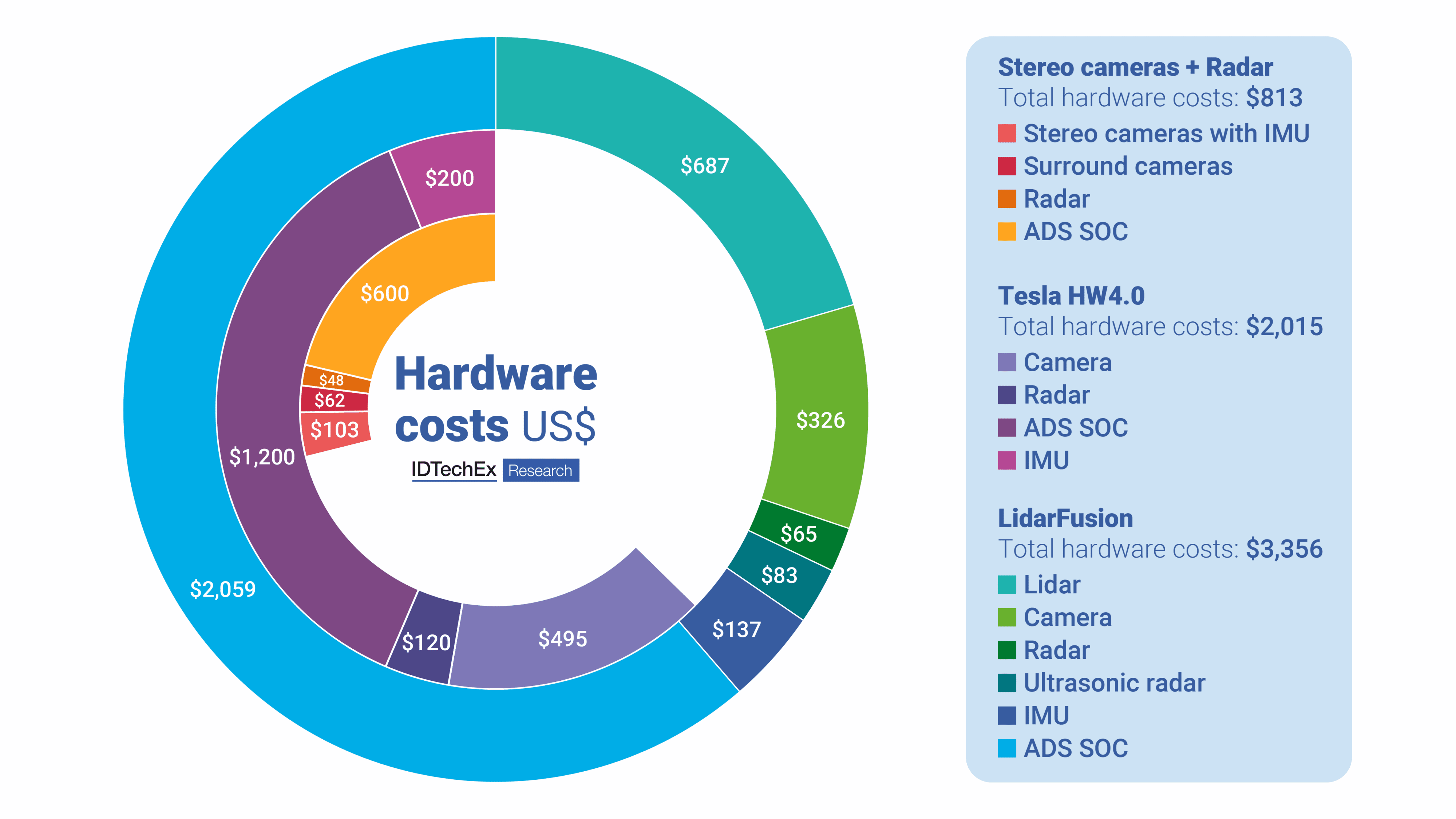

Vision-based systems—costing just $813 a pop—now command 63% of all new deployments, outpricing Tesla’s $2,000 sensor suite and demolishing LiDAR’s $3,500 bar tab. The ADAS future is in seeing, not spending.

Meanwhile… On the Global Grid

China isn’t just content with dominating its home turf. Globally, L2+ ADAS has exploded from a couple of niche models in 2017 to more than 50 by 2024. GM’s Super Cruise now lets you nap (legally-ish) across 800,000 miles of American highways, with Ford and Stellantis close behind. While true L4 autonomy is still searching for its killer app (read: automated valet parking in geofenced lots), L2+ is the pack leader for now.

The Road Ahead: Billion-Dollar Bets

IDTechEx, ever the traffic cop for disruptive technologies, predicts a US$20 billion prize waiting at the finish line for China’s L2+ ADAS visionaries by the 2040s—a figure buoyed by aggressive localisation, innovative suppliers, and a government backing technological independence like it’s an Olympic sport.

China’s L2+ ADAS parade is less about baby steps towards autonomy and more about running a marathon at sprint pace—with full-stack players dropping the baton only to pick up the whole relay team. Global rivals? They’re playing catch-up on a track that’s being redrawn every season. In China’s world, driving assistance is no longer extra—it’s the main course.

In other words: In the ADAS race, being “good enough” just doesn’t drive business anymore. It takes a whole-stack to win.