PRESS RELEASE

Latest UK data show that used electric vehicles are selling faster than used petrol (but diesel is still the fastest).

Data from Auto Trader’s Fastest Selling Index, which tracks the potential speed at which vehicles will sell based on live supply and demand in the market, has revealed that used electric vehicles (EV) are currently selling faster than their petrol counterparts for the very first time.

On average, a used EV is currently taking just 26 days to sell, which is two days faster than a used petrol vehicle (28), but two days slower than a used diesel (24). Remarkably, used electric vehicles are selling 41% faster than at the start of the year, leaving forecourts 18 days sooner than they did in January (44 days).

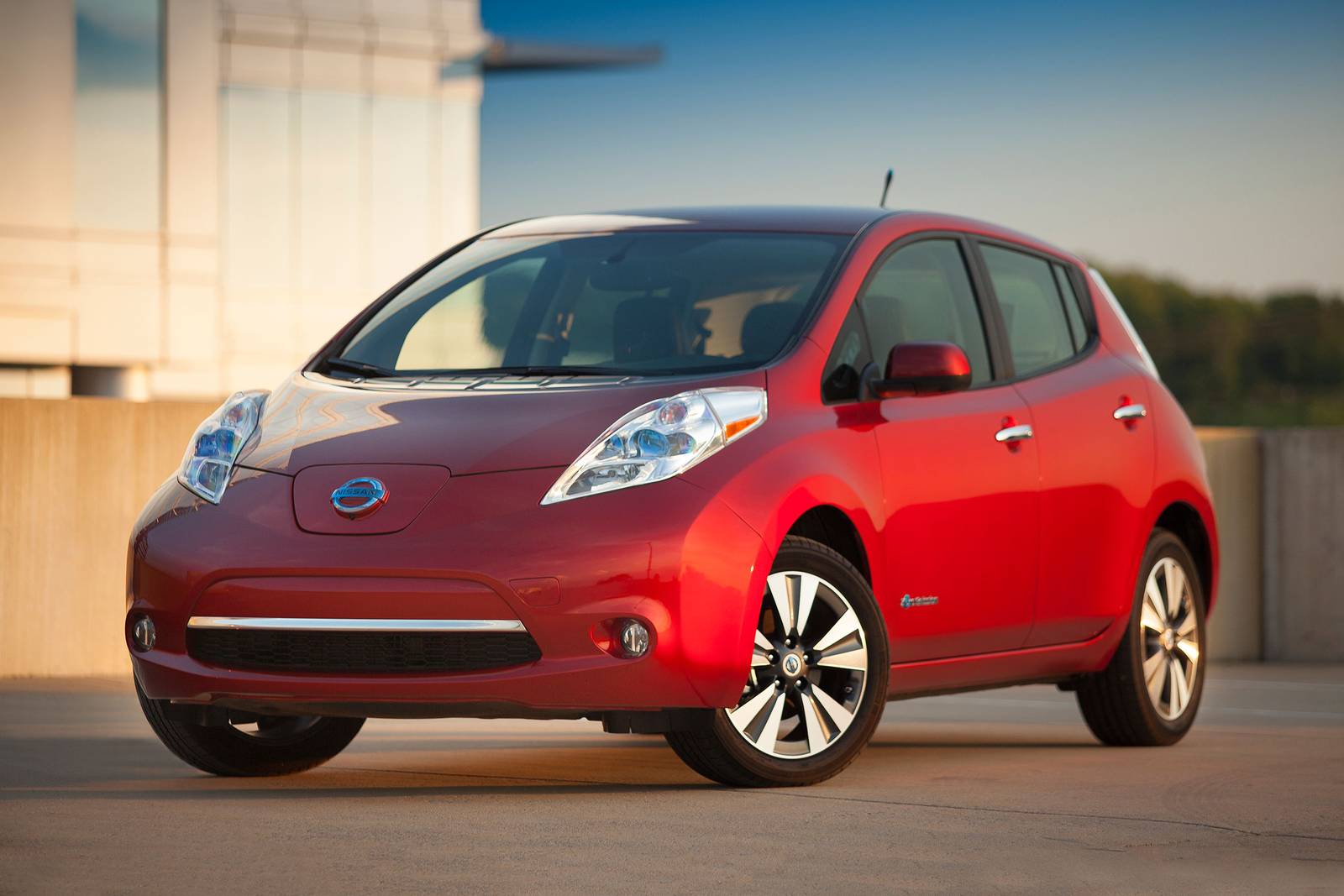

Looking at the data on a more granular level, it’s the ground-breaking Nissan Leaf (2017 registration) which holds the current title of fastest selling used EV in the UK right now, taking an average of just 20 days to leave forecourts. It’s followed into second place by the French electric supermini, the Renault Zoe (2016), which is taking 23 days to sell, and into third by the highly desirable Tesla Model 3 (2021), which is taking 27.

The staggering acceleration in the days to sell reflects the massive growth in consumer demand for electric, which is reflected in the 122.6% year-on-year increase in the volume of EV searches and advert views on Auto Trader. However, whilst the growth in popularity of both new and used electric vehicles is clear, they still represent a small percentage of the overall market, and evidence suggests only a small number of people show genuine intent towards purchasing one. In fact, on Auto Trader just 25% of EV considerers account for more than three quarters (79%) of all EVs looked at on its marketplace.

This reluctance is due, in part, to the significant price disparity in both new and used electric vehicles. The average sticker price of a ‘nearly new’ EV (under 12 months old) is currently 47% more expensive than its petrol or diesel equivalent, whilst a one year old is 40% more, a two year old is 39% more, and even a five year old electric car is over 10% more expensive. It’s no surprise then that 38%[1] of consumers identify the upfront expense of an EV as a primary barrier to entry.

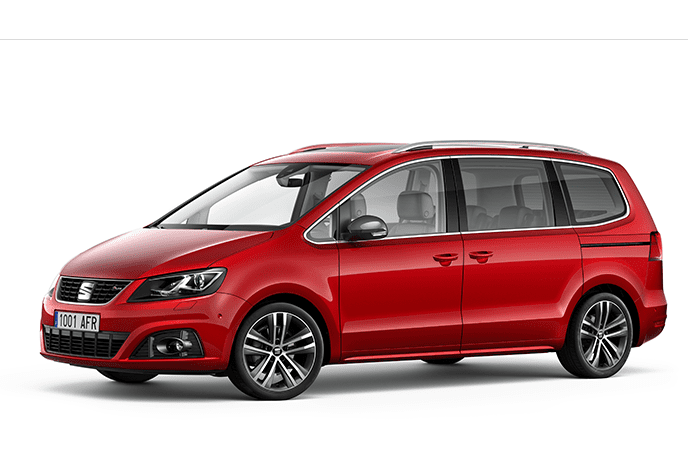

Despite the increased speed of sale for used EVs, looking at all fuel types across the total used car market, a pure-electric failed to make it on to the national list of fastest selling models. Hybrids were better represented, with the Hyundai IONIQ (2017) and Toyota Prius+ (2020) ranking at second and seventh respectively. However, it’s the much-maligned diesel that continues to dominate, representing seven of the top 10, including the number one spot with the SEAT Alhambra (2017), which is currently taking an average of just 15 days to sell.

Low emission vehicles are faring much better in the ‘nearly new’ market, making up four of the top 10 used cars aged under 12 months old. The petrol-hybrid Toyota Prius+ (2020) and Kia Niro (2020) are in first and seventh place, selling in 16 days and 27 days respectively. The pure electric Tesla Model 3 (2021) and MG ZS (2021) take the sixth and tenth spot, taking an average of 27 and 29 days to sell respectively.

Commenting on the findings, Auto Trader’s Director of Commercial Products, Karolina Edwards-Smajda, said: “The acceleration in the speed of sale of used electric vehicles reflects a significant increase in consumer demand this year, which has been driven by a myriad of factors, not least rising fuel costs. The used electric market will play an important role in driving mass adoption and reaching the government’s 2030 targets, however, as it stands, the ‘green premium’ for buying a new or used EV mean they remain out of reach for the vast majority of car buyers. If the government is serious in its ambition, it will need to do a lot more to make EVs financially accessible to more than just the most affluent; it would do well to take the lead from other European markets which are applying a smarter approach to incentives and a more comprehensive set of enabling policies.”